Used Vehicle Prices Continued To Moderate In August

Aug. 22, 2021

Prices for used vehicles fell slightly for the third consecutive month. Supply challenges continue to impact production.

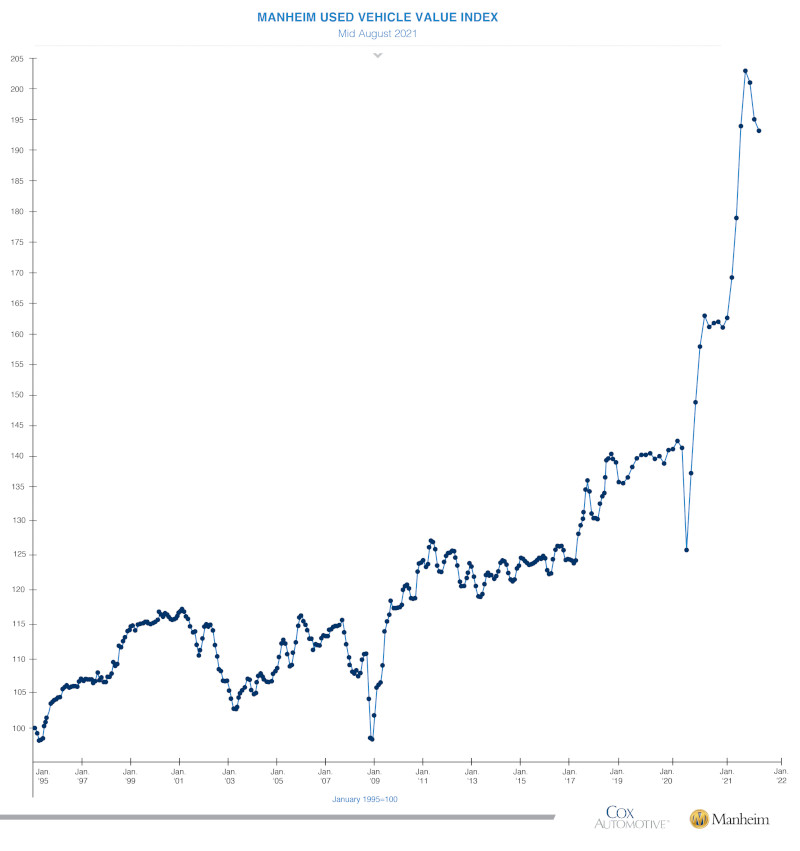

The Manheim Used Vehicle Value Index declined 0.8% month over month in the first half of August, which represents the third sequential decrease since prices peaked in May 2021. Used vehicle prices are up +19% year-to-date and +37% over the past two years. The sharp increase in used vehicle prices is due to lower production schedules at OEM manufacturers given supply chain constraints. This continues the trends we covered earlier this year.

This past week Toyota stated it would slash September production by 40% to 540,000 vehicles (revised down from 900,000 vehicles) as a result of semiconductor supply shortages. Volkswagen also warned it might need to decrease production further. "We currently expect supply of chips in the third quarter to be very volatile and tight," stated a Volkswagen spokesperson in an interview with Reuters.

Pat Gelsinger, CEO of Intel, said the worst of the global chip crisis was yet to come following second-quarter earnings. He predicted the shortage would get worse in the "second half of this year," and it would be "a year or two" before supplies returned to normal.

Used vehicle prices have risen at the sharpest pace in almost 30 years, according to Manheim data going back to 1995. Used retail supply has returned to a normal level of 42 days. Wholesale supply has also improved but remains below normal at 20 days (normal is 23 days). Used vehicle prices have been a major contributor to the overall increase in consumer price inflation this year.

Pickup and SUV price gains have moderated relative to much stronger trends earlier this year. Year-over-year price trends by segment include:

- Overall: +18%

- Vans: +25%

- SUV/CUV: +19%

- Midsize cars: +16%

- Luxury cars: +15%

- Pickups: +14%

- Compact cars: +15%

Source: Manheim.com

Takeaway: Prices accelerated meaningfully in 2021 as a result of the semiconductor shortage

Semiconductor shortages have plagued many supply chains during 2021. As we covered in second-quarter earnings summaries, construction equipment, agriculture equipment and heavy-duty truck manufacturers all cited semiconductor supply as an issue. Heavy-duty truck manufacturers noted very limited short-term visibility for production schedules, similar to what auto manufacturers cited this past week.

Find Similar Articles By Topic

#transportation #automotive #used vehicles #inflation #pickups