New & Used Medium & Heavy-Duty Truck Prices Will Likely Continue Rising Amid Components Shortages

Sept. 14, 2021

Widespread supply chain constraints, from semiconductors to specialty components, are causing production uncertainty amid strong demand for new and used medium and heavy-duty trucks.

New and used medium and heavy-duty truck prices are set to rise further amid strong demand from a hot economy and lower production due to supply chain constraints.

During the last few months, most medium and heavy-duty truck manufacturers noted severe supply chain challenges, as we covered in the transportation industry second quarter 2021 earnings summary.

Components shortages were cited by all major global truck manufacturers - Peterbilt, Kenworth, Volvo, Freightliner, Mack, International, etc. Many truck manufacturers were forced to take unplanned downtime because they did not have the parts required for assembly.

The industry supply chain issues continue to persist through the middle of September, and industry experts now believe components shortages could continue for the remainder of 2021 and into 2022. Lower truck production will ultimately result in higher new and used medium and heavy-duty truck prices, similar to the trend we have witnessed in the auto industry.

Higher new and used truck prices will result in higher freight rates, which will ultimately add upward pressure to general consumer price inflation.

ACT Research Slashed Its Near-Term 2021-2022 Production Outlook

ACT Research, an industry leader in covering Class 8 truck orders, sales, forecasting, used truck sales, freight rates and trailer sales, slashed its truck production outlook in its most recent monthly forecast as truck manufacturers continue to block and tackle supply chain constraints.

"In the current period of (near) record demand for commercial vehicles of all stripes, the story the past few months has shifted from one of abundance to one of constraint," said Kenny Vieth, ACT’s president and senior analyst. "While we say 'semiconductors' as a generic reference to the supply-chain’s shortcomings, in actuality there are scores of parts that continue to be impacted by the pandemic, by the lingering impact of steel tariffs, and even by the February storm that incapacitated Texas and shutdown swathes of the US plastics industry for two-plus quarters."

Class 8 orders are no longer aligned with build rates due to the parts shortages. Vieth said the industry should have produced about 30,000 Class 8 trucks in July based on orders but instead built just 14,820 units.

"Industry volume forecasting is typically a demand-side exercise," Vieth said. "For Class 8, we cut 2021 build expectations for a second consecutive month, but the story is materially different in the medium-duty sector. We attribute the smoother outcomes to date in Classes 5-7 to the fact that the large passenger vehicle-based market participants are able to pull chips from smaller, lower margin pick-up trucks and put those chips into medium-duty vehicles. Of course, the opposite is also happening amongst the Classes 5-8 producing CV OEMs, with the medium-duty market shedding chips into Class 8."

While much of the media has focused on semiconductors as a primary supply chain pinch point, it is important to note that ACT Research stated supply constraints now extend beyond semiconductors and into other components.

Source: ACT Research

Takeaway: Class 8 Heavy-duty truck production historically follows industry net orders. Recently the industry

has experienced the largest divergence on record going back 20 years - orders are high, while production is low.

New & Used Truck Prices Will Likely Continue Rising

Truck prices follow the basic economic principle of supply and demand - when supply is tight, and demand is high, prices rise. Currently, demand for medium and heavy-duty trucks is high due to the robust economy and high truckload freight rates. Rapidly increasing prices for transportation services are not limited to trucking - other transportation industries, including container shipping, are seeing strong price increases as well.

Source: Bureau of Labor Statistics

Takeaway: BLS data show long-distance truckload prices are rising at the fastest rate in over 15 years. Ultimately higher transportation costs

make their way into broader consumer goods prices, which increases general cost inflation.

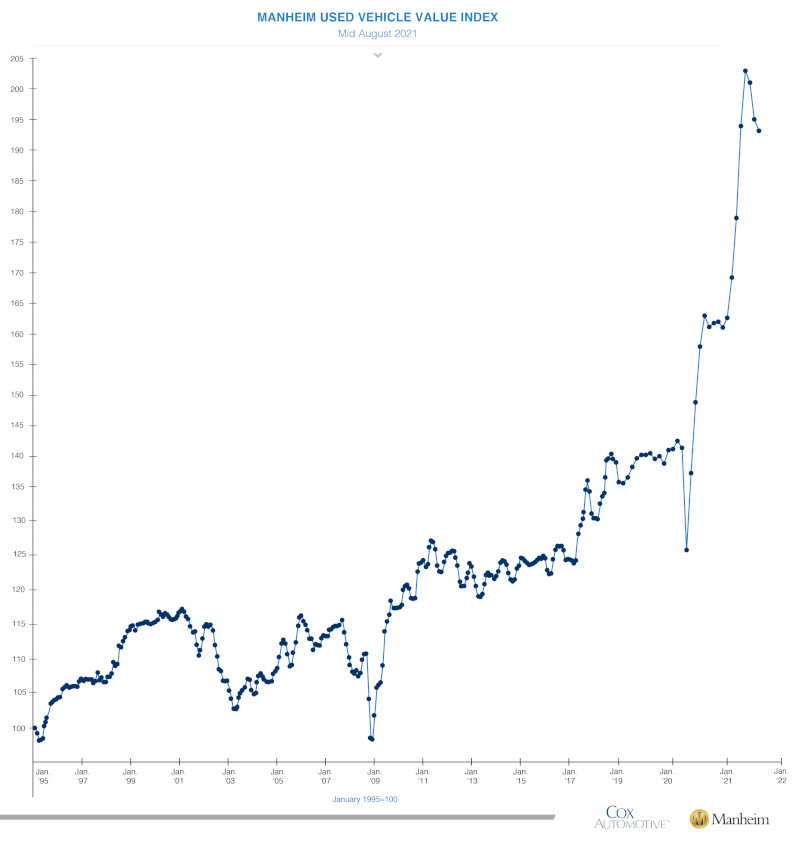

Components shortages are impacting a wide array of industries - from aerospace to farm and construction equipment. Used car prices have seen the steepest increase on record as a result of widely reported semiconductor shortages.

Source: Manheim Used Vehicle Price Index

Takeaway: Used vehicle prices have risen at the steepest rate on record, going back to 1995. As an anecdotal

data point, a friend of Equipment Radar recently sold his used car for $500 more than his purchase cost three years ago.

Semiconductor Cycles Tend To Be Volatile - This Cycle Will Be No Different

Intel's CEO Pat Gelsinger noted earlier this year that the semiconductor shortage could last beyond 2022. Semiconductor factories are expensive and take a long time to plan, build, and ramp up production. Semiconductor demand typically grows and contracts at a higher multiple than the broader economy - this makes the up and down cycles more extreme (for instance, if GDP growth is 3% then semiconductor growth is greater than 3%, and the opposite is true too).

"Imagine you’re an automaker and you want more of a chip and you are being quoted a lead time of a year. How many are you going to order? Are you going to order from multiple sources? You bet (you are)," said Willy Shih, a Harvard Business School professor who specializes in technology and manufacturing.

Semiconductor demand oscillates between boom and bust, and the current cycle will likely follow the same pattern. Semiconductor buyers tend to increase their strategic inventory stockpiles during tight supply and demand environments, similar to what we see now. If a buyer typically held two months of supply in normal times, they may target six months or more when they are concerned about securing supply. The change of strategic inventory and buying patterns further exacerbates an already tight market.

Eventually, semiconductor supply and demand will loosen as supply catches up, or demand moderates (typically demand moderates due to broader economic contraction at some point... supply increases take a long time to bring online). Once the market supply and demand forces normalize, demand will fall quickly because many semiconductor purchasers have larger-than-normal strategic inventories. Semiconductor manufacturers are well aware of this cyclical pattern, and it is a major reason why they are slow to add meaningful production capacity during an upcycle.

Resources

TruckNews.com

ACT Research: Used truck prices rise as secondary market inventory trickles